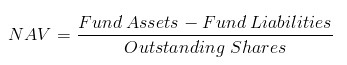

Mutual Funds are financial instruments. These funds are collective investments that gather money from different investors to invest in stocks, short-term money market financial instruments, bonds, and other securities and distribute the proceeds as dividends. The Mutual Funds in India are handled by Fund Managers, also referred as portfolio managers. The Securities Exchange Board of India regulates the Mutual Funds in India. The unit value of the Mutual Funds in India is known as net asset value per share (NAV). The NAV is calculated on the total amount of the Mutual Funds in India, by dividing it with the number of units issued and outstanding units on daily basis.

Anyone who is aware of the stock market is not new to mutual funds. Mutual funds have gained in popularity with the investing public, especially in the last two decades. Following are some of the primary benefits.

1. Professional Financial Experts

Every Mutual Fund scheme has a well-defined objective and behind every scheme, there is a dedicated team of financial experts working in tandem with a specialized investment research team. These experts diligently and judiciously study companies, their products, and performance, and after thorough analysis, they decide on the best investment option most aptly suited to achieve the scheme objective as well as investors financial goals.

2. Diversifying Risk

It plays a very big part in the success of any portfolio. Mutual funds invest in a broad range of securities. This limits investment risk by reducing the effect of a possible decline in the value of any one security. Mutual fund unit-holders can benefit from diversification techniques usually available only to investors wealthy enough to buy significant positions in a wide variety of securities.

3. Low Cost

Mutual Funds generally provide an opportunity to invest with fewer funds as compared to other avenues in the capital market. You can invest in a mutual fund with as little as Rs. 5,000 and also have the option of investing a little of Rs.500 every month in a SIP or Systematic Investment Plan.

4. Liquidity

You can encash your money from a mutual fund on an immediate basis when compared with other forms of savings like the public provident fund or the National Savings Scheme. You can withdraw or redeem money at the Net Asset Value-related prices in the open-end schemes. In closed-end schemes, a lock-in period is mentioned, an investor cannot redeem his investment until that period.

5. Variety of Investment

There is no shortage of variety when investing in mutual funds. There are funds that focus on blue-chip stocks, technology stocks, bonds or a mix of stocks and bonds and with due assistance from a financial expert, the investor can choose a scheme that aptly fits his requirements, and helps him achieve maximum profitability.

Sometimes selection becomes really difficult and confusing due to large number of schemes available in Mutual Fund industry.Here in you need to compare various schemes to find a final best for your portfolio.

Our following sheet of Compare Funds can help you to track & identify the best fund managers & their schemes for investing.

Mutual funds offer investors the opportunity to earn an Income or build their wealth through professional management of their investible funds. The primary role of mutual funds is to assist investors in earning an Income or building their wealth, by participating in the opportunities available in the securities markets.

The majority of the investors buy when the market has already run up and is valued expensively. This often leads to disappointment when the market either goes down or sideways for years.

Portfolio errors might also have been committed by the investor. A common mistake is over-diversifying with too many funds, which can be difficult to keep tabs on and can tend to average out to market performance.

A good fund can provide better cash flow to their investors in terms of dividend payout.Also,dividends are tax free in India,which enhances post tax return for the customer.

Our following sheet of Dividend Announcements can help you to track & identify the funds which has announced dividends.

The investment that an investor makes in a scheme is translated into a certain number of 'Units' in the scheme. Thus, an investor in a scheme is issued units of the scheme.

When the investment activity is profitable, the true worth of a unit goes up; when there are losses, the true worth of a unit goes down. The true worth of a unit of the scheme is otherwise called Net Asset Value (NAV) of the scheme.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments. Option of Direct Plan for every Mutual Fund Scheme is available to investors offering advantage of lower expense ratio. We are not entitled to earn any commission on Direct plans. Hence we do not deal in Direct Plans.

AMFI Registered Mutual Fund Distributor – ARN-41121 | Date of initial registration – 18th Feb, 2006 | Current validity of ARN – 16th November, 2028

Grievance Officer- Rupak Mehta | Divyafeed@gmail.com

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors